Financial hardship is a common experience for patients and their families after the diagnosis of a hematologic malignancy and is associated with worse outcomes. Health care costs, increased costs of living, income poverty, and inadequate wealth contribute to financial hardship after the diagnosis and treatment of a hematologic malignancy and/or hematopoietic cell transplant. Given the multidimensional nature of financial hardship, a multidisciplinary team-based approach is needed to address this public health hazard. Hematologists and oncologists may mitigate the impact of financial hardship by matching treatment options with patient goals of care and reducing symptom burden disruptive to employment. Social workers and financial navigators can assist with screening and resource deployment. Policymakers and researchers can identify structural and policy changes to prevent financial hardship. By alleviating this major health care burden from patients, care teams may improve survival and quality of life for patients with hematologic malignancies.

Introduction

Financial hardship is defined as unmet basic needs and other living costs due to insufficient economic resources.1 In the most extreme circumstances, financial hardship can include severe poverty, bankruptcy, and medical abandonment.2 Holistically, it is a continuous concept with levels of extreme, moderate, and minimal severity. Financial hardship includes burdens specific to the effects of certain diseases, such as a long treatment course interfering with the ability to work and leading to high out-of-pocket costs. Patients and their families can also experience more general financial burdens that apply to all populations, including food insecurity and housing instability.1,3 A common term related to financial hardship in oncology is financial toxicity. Financial toxicity is a more circumscribed concept than financial hardship, specifically referring to the negative financial effects of cancer and treatment.4-6 Other related terms include financial burden and economic well-being.7 The past 15 years have seen an explosion in research on financial hardship in medical populations, which is well justified given the potential effects of financial hardship on survival.8-10 As the American Society of Clinical Oncology’s position statement on the effects of the cost of cancer care noted, high-quality cancer care has become unaffordable for many patients.11

Financial hardship is a complex, multidimensional experience. Patients, their caregivers, and other family members may experience financial hardship through material hardship (consequences and impacts to one’s finances), psychological aspects (such as worry or depression), and/or coping behaviors (how individuals respond to financial stressors).1,12-14 These psychological aspects of financial hardship are sometimes termed financial stress or financial distress. Coping behaviors and other forms of material hardship are sometimes referred to as financial stress or strain. Regardless of terminology, addressing financial hardship represents a major priority for patients and their families.

In this Viewpoint article, we first summarize the literature on financial hardship with a primary focus on hematologic malignancies and hematopoietic cell transplant (HCT), incorporating research from solid tumors and the general population as needed. A high-level summary of financial hardship research in hematologic malignancies and HCT is featured in Table 1. Finally, a pragmatic action plan to address financial hardship for each member of the health care team is presented.

Summary of evidence on causes and effects of financial hardship in hematologic malignancies

| Cause or risk factor . | Findings . |

|---|---|

| Employment | Not being able to work is associated with more financial hardship, particularly for families of children with hematologic malignancies.15-18 |

| Health insurance coverage | Having health insurance or better coverage (insurance covers more costs) is associated with lower risk of financial hardship in HCT and studies including people with hematologic malignancies.19,20 |

| Comorbidities | Studies including people with hematologic malignancies have found more comorbidities to be associated with greater risk of financial hardship.21,22 |

| Age | Younger adults (aged, 18-39 y) and middle-aged adults (40-65 y) consistently report more financial hardship than older adults (aged, 65+ y) including in HCT and hematologic malignancy samples.23,24 Families with children diagnosed with hematologic malignancies are also more likely to experience financial hardship.25,26 |

| Cause or risk factor . | Findings . |

|---|---|

| Employment | Not being able to work is associated with more financial hardship, particularly for families of children with hematologic malignancies.15-18 |

| Health insurance coverage | Having health insurance or better coverage (insurance covers more costs) is associated with lower risk of financial hardship in HCT and studies including people with hematologic malignancies.19,20 |

| Comorbidities | Studies including people with hematologic malignancies have found more comorbidities to be associated with greater risk of financial hardship.21,22 |

| Age | Younger adults (aged, 18-39 y) and middle-aged adults (40-65 y) consistently report more financial hardship than older adults (aged, 65+ y) including in HCT and hematologic malignancy samples.23,24 Families with children diagnosed with hematologic malignancies are also more likely to experience financial hardship.25,26 |

| Effect . | Findings . |

|---|---|

| HRQOL | People with hematologic malignancies and undergoing HCT have worse HRQOL if they also have financial hardship.27-29 |

| Mortality | Financial hardship is associated with earlier mortality in hematologic malignancies in some studies10 but not others.27 |

Negative effects of financial hardship

Financial hardship is associated with adverse outcomes in mental and physical health. Several studies in people with hematologic malignancies27 and those undergoing HCT28,29 have linked higher degrees of financial hardship with worse health-related quality of life (HRQOL). Studies from the general population have consistently shown that the experience of financial hardship is associated with earlier mortality.30-32 This association of earlier mortality with financial hardship was also demonstrated among patients with solid tumor cancers8,9 as well as hematologic malignancies,10 although the data in hematologic malignancies have been inconsistent in regard to these associations.27 Reducing financial hardship is a worthy outcome alone but could also improve HRQOL and survival.

Causes of financial hardship

Several causal and risk factors of financial hardship have been identified, many of which are modifiable. A major cause of financial hardship is reduced income or income poverty.33 Income is money regularly received for work or from investments.34 Income poverty is defined by the federal government as having a household income less than the official poverty threshold according to the number of persons and children in the home.35 Reduced income is often an indirect consequence for patients and their caregivers because they are required to take extended time away from work due to changes in work-for-pay arrangments.36,37 At this time in the United States, there is no requirement for paid sick leave. As such, patients and their caregivers may experience significant reductions or completely lose their income for several months or even years.15,38 The National Family and Medical Leave Act (FMLA) guarantees 12 weeks of unpaid leave, only if the company has ≥50 employees and the patient or caregiver has been working there for ≥1 year. Although all people with cancer are at risk of disrupted employment, the long inpatient stays associated with the treatment of some hematologic malignancies could put this population at especially high risk for reduced income.39 This leaves a gap for many patients and caregivers without financial support in the context of a new cancer diagnosis and subsequent treatment. Reduced income as a cause of financial hardship may lead patients and families to use retirement funds or go into debt if they do not have sufficient financial resources.

Within the context of financial hardship, it is key to distinguish income from wealth. Wealth refers to financial assets that a person currently owns and can be liquid (eg, savings accounts) or nonliquid (eg, home ownership).40 In the United States, wealth is inequitably distributed, such that historically marginalized racial and ethnic groups are significantly less likely to accrue wealth41 and are more likely income poverty exposed.42 The root cause of these inequities is structural racism or policies and practices within economic, justice, health, and educational systems resulting in the societal imbalance of power distributed across racial and ethnic groups.43 Over time, for marginalized peoples, intergenerational poverty, segregation, and limited social mobility precluded wealth building,44 a buffer for financial hardship.45 It is therefore not surprising that, at the time of diagnosis, patients and their caregivers who identify as Black or Hispanic are more likely to experience more severe financial hardship after a cancer diagnosis than their non-Hispanic White counterparts.36,46,47 Today, an individual’s race and ethnicity therefore remain significantly associated with financial hardship due to the perpetual societal force of racism.

Although undoubtedly mutually dependent, lacking health insurance or being underinsured are often associated with experiencing higher levels of cancer-related financial hardship.48-50 Beyond being a proxy for income, insurance by definition represents access to health care. Underinsurance is associated with greater comorbidities and poor health, which plausibly exacerbate financial hardship.51 Insufficient health insurance can lead to higher out-of-pocket costs for treatments through higher copays, coinsurance, and out-of-network or off-formulary care.19,20 An analysis of National Health Interview Survey data showed people with hematologic malignancies had higher health care utilization than those with solid tumors, potentially resulting in higher out-of-pocket costs.52 Additional health insurance costs can include premiums and lower wages.1 Certain administrative burdens associated with the use of health insurance may increase the likelihood of financial hardship.14 Prior authorizations are an example of an administrative burden and involve the patient and physician completing additional, often excessive, amounts of paperwork to gain insurance coverage for care.53 These administrative burdens could shift health care costs from insurers to patients and their families. Although having any health insurance is helpful, the level of insurance coverage can be critical in determining whether patients and their families experience financial hardship.

Risk factors for financial hardship

In addition to socioeconomic causal factors including income, insurance, and exposure to structural racism, individual factors can exacerbate financial hardship. Pertinent factors include individuals’ comorbidities before diagnosis,21 intensity of treatment (including HCT) and/or resulting toxicities, and age.22,23 Among patients with solid tumors, side effects or complications requiring extended treatment duration, emergency room visits, and/or hospitalizations can substantially increase out-of-pocket costs.14 In addition, the symptoms of these side effects and complications can also reduce patients’ and their caregivers’ ability to work, an effect frequently observed among those treated for hematologic malignancies, including HCT.15,54-59 Health behaviors, such as exercise and maintaining a healthy diet, can also affect financial hardship through reducing side effects and symptoms, but these often have a monetary cost as well.14 Another consistent finding is that younger adults have higher levels of financial hardship after HCT or hematologic malignancy diagnosis than older adults.23,24 Medicare coverage likely contributes to this difference, but younger adults are also more likely to be working at the time of diagnosis and have a greater need to maintain income, having had less time to build wealth as a buffer against financial hardship, as suggested by data from the general population.60 Employment disruptions from HCT in particular might be more impactful for younger vs older adults.

Children and adolescents are uniquely vulnerable to financial hardship as dependents. Although youth account for 22% of the US population, they make up 31% of Americans living in poverty.61 In the case of youth with cancer, financial hardship is shared by not only the patient but also their caregivers. Caregivers of pediatric patients, who are frequently younger than most adults with cancer, often face work disruptions precipitated by intensive treatment and caregiving requirements.16 In a recent collaborative group trial of children with acute lymphoblastic leukemia, 46% of families experienced loss of employment during treatment and 68% decreased work hours.15 Longitudinal research among children with all types of cancer suggests that parental income drops precipitously soon after diagnosis, and deficits in income, particularly among mothers, persist and may widen over subsequent years.17,18 Among long-term survivors of childhood cancer, including those with hematologic malignancies, financial hardship is more prevalent than noncancer controls.25,26,59 Notably, long-term survivors who underwent HCT reported rates of financial hardship similar to those without a history of HCT.26 Childhood cancer survivors also report lost productivity from work disruptions at similar rates to what is observed in survivors of cancers in adulthood.62 Finally, emerging evidence may suggest that siblings of children with cancer can also experience increased financial hardship,63 potentially speaking to long-term family impact.

Gaps in knowledge

Although numerous studies have examined financial hardship and demonstrated negative effects on HRQOL, significant gaps in knowledge about this outcome remain. Although employment and insurance coverage are identified causes of financial hardship in hematologic malignancies and other cancers and therefore potential intervention points,38,50 practices, policies, and interventions best positioned to prevent financial hardship are less well understood. Although some financial navigation interventions may be effective for reducing financial hardship,64 the best intensity of financial interventions, specific types of support, and how best to incorporate these interventions into clinical care are unknown. Also less studied is how structural racism can be addressed to prevent disparities in financial hardship. The role of the health care team in reducing and preventing financial hardship must be considered within this context.

The role of the health care team in addressing financial hardship

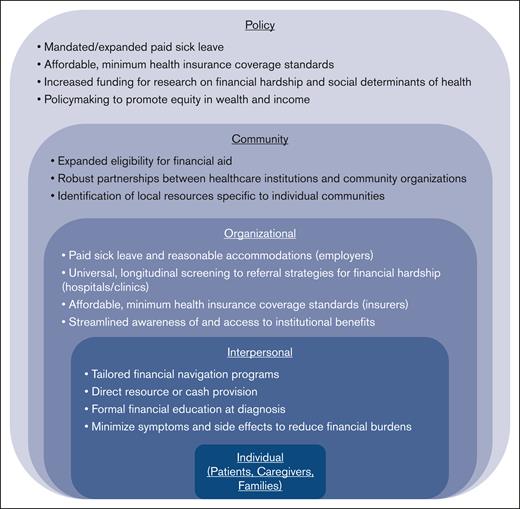

Financial hardship in patients with hematologic malignancies, including those who have received HCT, is a multidimensional, multicausal phenomenon that cannot be fully prevented or addressed by a single member of the health care team. Each member of the health care team has distinct, yet complementary roles, in addressing financial hardship. We use an inclusive definition of the health care team that includes physicians, advanced practice providers, nurses, medical assistants, social workers, financial navigators, and others providing direct patient care, as well as policymakers, insurers, employers, and leaders of health care organizations. We outline key roles that these members have in reducing and preventing patient- and caregiver-level financial hardship. Table 2 summarizes the roles of each member of the team, as well as who is potentially affected by actions taken to reduce financial hardship. Figure 1 outlines how clinicians, employers, insurers, researchers, and policymakers fit within each level of the socio-ecological model as well as how community organizations can help until longer-lasting changes are enacted.65

Summary of roles in addressing financial hardship

| Team member . | Action . | Potential direct effects . |

|---|---|---|

| Physicians and advanced practice providers |

| Patients, caregivers, and families |

| Nurses and medical assistants |

| Patients, caregivers, and families |

| Social workers and financial navigators |

| Patients, caregivers, and families |

| Insurers |

| Patients, caregivers, and families and clinical team |

| Employers |

| Patients, caregivers, and families |

| Researchers |

| Policymakers, insurers, employers, and clinical team |

| Policymakers |

| Employers, insurers, patients, caregivers, and families |

| Team member . | Action . | Potential direct effects . |

|---|---|---|

| Physicians and advanced practice providers |

| Patients, caregivers, and families |

| Nurses and medical assistants |

| Patients, caregivers, and families |

| Social workers and financial navigators |

| Patients, caregivers, and families |

| Insurers |

| Patients, caregivers, and families and clinical team |

| Employers |

| Patients, caregivers, and families |

| Researchers |

| Policymakers, insurers, employers, and clinical team |

| Policymakers |

| Employers, insurers, patients, caregivers, and families |

Actions to address financial hardship in hematologic malignancies at each level of the socio-ecological model.

Actions to address financial hardship in hematologic malignancies at each level of the socio-ecological model.

Clinical team

Many of the skills for which physicians and advanced practice providers (collectively called providers) are trained to treat hematologic malignancies can be readily applied to address financial hardship. With medical treatment, achieving cure while minimizing disease symptoms and treatment side effects is often a central care goal. As described above, side effects and symptoms, short and long term, can contribute to financial hardship through increased out-of-pocket costs and difficulty maintaining income.14 Providers’ roles in reducing disease symptoms and treatment side effects are a cornerstone of both preventing and reducing financial hardship. A key aspect of this role is helping patients and their caregivers with medical decision-making, which may include balancing treatment risks, benefits, and HRQOL. Some therapies with curative intent may expose patients to harmful side effects and unwanted symptoms; however, even with a central goal of achieving a long-term cure, minimizing symptoms within this context may alleviate downstream financial effects. A patient’s context can affect the relative priority they and their caregiver(s) place on maintaining work for pay during treatment. For example, 1 patient may be able to work remotely with a flexible schedule, whereas another has a very physical, in-person job. These 2 patients may differently prioritize which treatment side effects they prefer to minimize and which dimensions of HRQOL they prefer to preserve. Fostering a supportive care relationship in which patients can openly share treatment side effects and symptoms before they worsen can help prevent additional costly treatment and time off work. Following best practices to reduce unnecessary, low-value care may help reduce costs to the health care system and limit unnecessary use of finite resources, potentially generating savings for patients and their families.66-70 For example, evidence-based transfusion stewardship recommendations from the American Society of Hematology and American Society of Pediatric Hematology/Oncology have been proposed to limit unnecessary transfusions among patients during therapy. Adherence to these guidelines, when reasonable, may not only limit potential toxicities but safely reduce costs to patients. Behaviors such as a healthy diet and reasonable amounts of physical activity can help patients reduce symptoms and side effects, in turn reducing financial hardship. The role providers play in the health care team is a crucial part of addressing financial hardship. The role of palliative care in providing support to patients and families around the use of allogeneic HCT continues to expand.71,72 Current efforts explore utilization of supportive and palliative cure during induction therapy for acute myeloid leukemia and during curative allogeneic HCT to minimize symptoms, reduce burden of stress, and develop coping strategies that could ultimately reduce overall costs by reducing unplanned clinic visits and hospitalizations. Palliative care could also improve ways to make decisions for treatment choices that may save resources to patients and families.73,74

In addition to managing medical treatment, providers can help address financial hardship through other means. Providing patients and their families with accurate, objective information about prognosis and treatment side effects is key to help families decide between different treatment plans if multiple standard-of-care options are available. Treatment options may vary significantly in cost to the patient, and consideration of cost cannot be considered without disclosure. Although financial implications of medical treatment are a component of medical training, further training for providers on navigating medical decisions and consequent financial toxicity experienced by patients would be beneficial. Nonetheless, even if care recommendations are not affected, patients and their families still report a desire to discuss the costs of care.75-77 Cost discussions can often reduce financial stress for patients and their families, because they know what to expect and can prepare if needed. In some cases, cost discussions may actually reduce patients’ costs without negatively affecting care.78

Universal and timely screening for financial hardship is critical. The Centers for Medicare and Medicaid Services, Joint Commission, and National Committee for Quality Assurance all recommend screening for financial hardship in health care systems.79-81 Many cancer centers routinely screen patients for financial hardship, although approaches and capacity to respond to a positive screen vary substantially.82 Surveys of clinics and hospitals across specialties have found anywhere from 56% to 77% report screening for financial hardship, sometimes called social risks.3,83 Health care team members are capable and responsible for screening patients. For example, care team members who interface with high number of patients throughout the day, such as nurses and medical assistants, have successfully supported systematic screening for financial hardship.82 Given the constraints within a busy clinic, screening questionnaires must be practical and efficient to administer, such as an abbreviated 2-item screener used for patients in a breast cancer clinic.84 In some cases, patients or caregivers may feel more comfortable disclosing financial hardship with their care team.75 Nurses, medical assistants, care navigators, and providers with a strong therapeutic relationship with a patient or family may be able to sense when someone is experiencing financial hardship.75 In such situations, an adept team member may normalize financial hardship and ask gentle probing questions. Regardless of who identifies financial needs, these should always be triaged to social workers or financial navigators. Still, a general awareness of available financial resources can help clinical team members facilitate these conversations before referral. Cognizance of financial hardship-related inequities,36,46 while still being knowledgeable to each individual situation, is key to personalize provision of assistance in an equitable way.

Providers can also work with other team members to complete paperwork for patients to access benefits such as paid sick leave, short-term disability insurance, FMLA benefits, and reasonable work accommodations through the Americans with Disabilities Act. The level of administrative burden for patients to access benefits such as FMLA and Americans with Disabilities Act has been previously documented.85,86 These burdens often spill over to providers who must complete forms or write letters, often at regular intervals, so patients and their families can access these protections and benefits. However, these benefits can be a crucial coping strategy for patients and caregivers to reduce and avoid financial hardship. Whether reducing symptom burden, identifying financial hardship, or assisting with benefits paperwork, hematology/oncology providers and other clinical team members play a central role in addressing financial hardship.

Several interventions addressing financial hardship in patients with hematologic malignancies and other cancers have been developed. These interventions include financial navigation,87-89 health insurance education,90 direct resource provision,89,91,92 and cash assistance.93 Social workers and financial navigators can help deliver these interventions, such as addressing health insurance or basic needs concerns, or they can connect patients and their families to community-based organizations that provide assistance. Patient navigators and financial navigators may be able to assist with the administrative burdens when accessing health insurance, paid sick leave, or financial aid. Other members of the health care team, such as nutritionists and physical therapists, can help patients maintain a healthy diet and physical activity. Accounting for the complexity and diversity of causes for financial hardship, any solution will require utilization of the entire health care team.

Researchers

For the purposes of this Viewpoint article, we take a very inclusive view of the health care team that includes researchers, insurers, employers, and policymakers, all of whom play a specific role in identifying structural, community, organizational, and policy causes and have the responsibility of addressing financial hardship.94 We start with a focus on the research agenda before turning to how institutions (eg, insurers and employers) and policymakers can address financial hardship. The role of administrative burden in preventing access to health insurance and employment benefits is only starting to be studied.85 These burdens include prior authorizations, denials of insurance benefits, and excessive medical exams and paperwork for paid time off work. Researchers can identify the most effective ways to reduce these barriers for patients, their families, and physicians who often complete the paperwork associated with these administrative burdens. Another role for researchers is identifying treatments with fewer or less severe side effects, potentially reducing out-of-pocket costs and unpaid time away from work. The out-of-pocket costs of any new treatments will have to be kept low through policy interventions to ensure any reduction in financial hardship is not counterbalanced by increased treatment costs. Economic considerations, from the perspectives of both health systems and patients, are moving to the forefront of studies and clinical trials.95 Further research on patient perspectives, including how best to communicate about and alleviate financial toxicity, will be key to improving patient experience and patient-reported outcomes.

The evaluation of patient- and family-level financial hardship interventions, such as financial navigation and connection to community-based resources, is another important area for future research. Researchers can inform health care systems, policymakers, employers, and health insurers about the best approaches to reduce or prevent financial hardship. A recent meta-analysis of financial navigation and education interventions in adults with cancer, including hematologic malignancies, found promising initial evidence of efficacy for reducing financial hardship.64 These interventions included financial navigation and financial education. However, the outcome measures did not adequately assess each dimension of financial hardship and may have not been sensitive to change, suggesting that additional measures are needed to evaluate these interventions.64,96,97 One author of this article has developed measures of financial hardship for adults with cancer, including those with hematologic malignancies, and another author is in the process of developing a financial toxicity measure for pediatric hematology/oncology.14,98 In addition to outcome measure development, continued intervention evaluations are needed, particularly which types of interventions should be delivered for which patients.

Institutions

Employers and insurers can also help prevent financial hardship. Even if not required by federal or state law, employers can choose to provide paid sick leave that is easy to access with minimal administrative burden. Of the 34 Organization for Economic Cooperation and Development nations, 32 guarantee paid sick leave, with the United States and South Korea being the 2 exceptions.99 Furthermore, paid sick leave of as long as 6 months is likely economically feasible, with public funds supplementing employer paid sick leave in excess of 2 weeks. Employers can also provide reasonable accommodations such as remote work, adaptive tools, or adaptive workstations (ie, for metal workers). Although no employment solution will work for every person with a hematologic malignancy, a combination of solutions could help ensure that patients and caregivers can maintain some degree of their baseline income. Health insurance companies can reduce charges for copays and coinsurance, particularly for high-value care. We also recommend that health insurance plans streamline the prior authorization and appeals process, which is associated with significant stress and administrative burden for patients with a variety of cancers.100 For example, 1 study at a pediatric oncology center found prior authorizations to be approved >98% of the time, suggesting that less-stringent policies from insurers could improve efficiency.101 These organizational level changes around paid leave, employment supports, and costs of care could help reduce financial hardship.

Policymakers

Policymakers at local, state, and federal levels can also help address financial hardship. An example at the state level is the Washington State Paid FMLA program.102 The federal law on work leave, FMLA, guarantees 12 weeks of unpaid leave and only in certain circumstances. The Washington State program fills the gaps in FMLA by providing paid leave when not already available from employers, and covering some workers not protected by FMLA. Paid FMLA requires a minimal amount of paperwork (usually 1 page), to be completed by the health care team. As of April 2024, similar laws concerning paid medical leave have been passed in 14 other states and the District of Columbia.103 An additional role for policymakers is to develop programs that provide temporary financial support during treatment for major medical conditions, such as hematologic malignancies and/or diagnoses necessitating HCT. The Guaranteed Income and Financial Treatment trial provides unconditional cash payments to patients with low income who are undergoing cancer treatment.93 Results of the trial could support a similar benefit program for people undergoing HCT. Policymakers can also set minimum coverage standards for health insurance to prevent high out-of-pocket costs, as was recently implemented for insulin covered through Medicare,104 and also negotiate for lower drug costs, as will be implemented soon for Medicare. Policy change may come more slowly than health care system and institutional changes but may have broad, powerful effects. Although physicians and the rest of the health care team provide immediate patient- and family-level interventions to address financial hardship, researchers and policymakers can identify solutions to prevent financial hardship at the community and policy levels.

Summary

Financial hardship after a hematologic malignancy diagnosis and/or HCT has complex causes and requires multilevel solutions. A multidisciplinary team approach is critical to mitigate financial hardship and its adverse effects on patients and caregivers. A research agenda focused on improved measurement, continued evaluation of interventions, and identification of specific policies to prevent financial hardship in hematologic malignancies is needed. An additional critical piece of the research agenda is how to reduce administrative burdens for the patient and the clinical team when accessing insurance and employment benefits. Until political and structural change is implemented to prevent and reduce financial hardship for patients and caregivers, it will be necessary for all health care team members to use existing resources and skills to minimize financial hardship.

Authorship

Contribution: S.M.W.J. provided conceptualization, wrote the original draft, and contributed to reviewing and editing; and T.J.D.O., K.A.K., and M.S. provided conceptualization and contributed to reviewing and editing.

Conflict-of-interest disclosure: M.S. was a consultant for and received honorarium from Jazz Pharmaceutical and research funds from BlueNote. The remaining authors declare no competing financial interests.

Correspondence: Salene M. W. Jones, Public Health Sciences Division, Fred Hutchinson Cancer Center, 1100 Fairview Ave N, Seattle, WA 98109; email: smjones3@fredhutch.org.